Egypt has the world's third-highest unbanked population, according to the World Bank's Global Findex.

While the vast majority of Egyptian fintech startups are attempting to target unbanked consumers, we at Fintold have decided to shift our focus to another vital unbanked sector in Egypt that is driving the Egyptian economy: unbanked SMEs.

Egypt's SME sector accounts for more than 80% of all economic activity, but their contribution to GDP is less than 25%. This is due to multiple factors, on top of them is liquidity issues and lack of access to finance. One of the key metrics to highlight this issue is that only 5% of small businesses in Egypt have bank loans, according to official statistics.

As an Egyptian fintech startup, we must obtain approval and licencing from multiple financial regulators, including the Central Bank of Egypt (CBE). And, while fintold wanted to offer a financial product that provided unbanked SMEs in Egypt with access to financing resources, they were constrained by the same financial regulations and banking procedures that kept this large sector out of the banking field in the first place.

I was the company's first and only designer when I started at fintold. Fintold's team has grown from one to five developers, including back-end, front-end, and android engineers.

That meant I had to work closely with founders to build the product from scratch. Including the design team.

I had to educate myself about the field and the company I had just joined. What is fintech? What is the problem we are trying to solve in the market? Why do we as a startup exist? What are we trying to accomplish? What is banking? How do banks work in Egypt? What is the supply chain? What is supply chain finance? What are the regulations for financing in Egypt? Where are we as a startup? Where do we want to go?

I worked with Fintold's CEO to discuss the idea of the startup, his point of view on the problems he is trying to solve in the market, why these problems exist in the first place, what customers are we trying to target, and why, what are the limitations and what is his vision for the startup and the products we want to launch now and in the future. I also started educating myself on the basics of financing, read books about banking and digital banking, took crash courses about banking and fintech, joined fintech communities on Spotify and listened to podcasts, and joined more specialized UX Research websites. I also had meetings with the technical head of the company (CTO) to understand the technical limitations and expectations for our products, and the technical environment where we will be operating and building our product. From this, I was able to build a good enough understanding of what our solution is, what problems our targeted customers are facing, some of the financial terms we are using and the banking environment in Egypt.

The first thing we did was that we laid out a big picture of the main customers we are trying to target. It was obvious from the beginning based on our research and statistics that our main target will be the unbanked SMEs, but how do we reach them? What sectors, what size, and which financial product will suit them best? Is it a one-solution fits, or do we have to customize our solutions to match each business size and field? And what are these targeted customers’ expectations from financial products, do they trust fintech startups? What exactly was limiting their access to financing resources from different banks in Egypt?

We drew a main persona for the targeted users, it was a general one. Mainly SMEs, located in the capital (Cairo) & Alexandria, with a stable financial record and no or limited access to financial resources in banks, and most importantly are dealing with other smaller SMEs.

We searched for and found SMEs that match this persona, and we connected with their managers or CFOs for initial meetings. From that, we created a list of targeted customers for interviews.

I joined the interviews, which usually had two sections, one is financial, where I would be the observer, recording and taking notes, aiming to understand their pains from the financial solutions currently available in the market and their expectations. The other part was technical, where we would be discussing the technical skills of the staff, expectations, understanding the environment inside their company, how they do day-to-day tasks, how they handle transactions, invoicing, etc

During this phase, I conducted:

We came to these conclusions based on our findings

The lack of a seamless process was a major barrier to financing.

Businesses need faster and more efficient access to money due to long wait times for bank procedures.

PCs & laptops were still the dominant device, with Office programs being the most comfortable tools used across most employees.

Banks are the biggest source of trust and financial resources in the Egyptian financial market, offering the best pricing, most trusted, and most reliable solutions.

Our user interviews revealed multiple problems and needs of our users, which we wanted to address.

By this stage, the financial solution has already been decided on, based on the financial talks with banks and business owners, our finance head was able to shape the financial product to be offered; Supply chain finance.

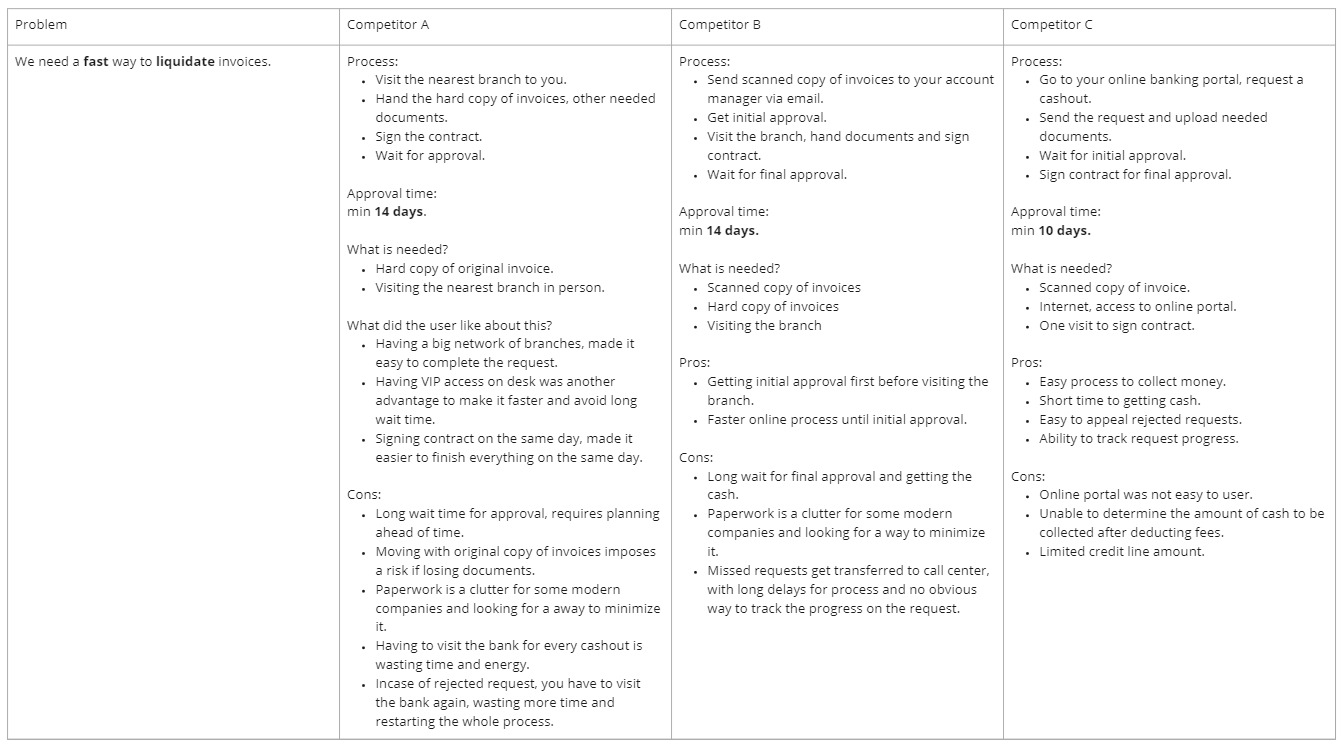

Because we were a first-of-a-kind solution, I looked at indirect competitors in the local markets. What are our customers’ current financing resources?

I studied banks, some financial institutions that offered old-school financing solutions close to supply chain finance, and one fintech startup that was not yet launched in the market and is pending CBE’s approval.

During the study, I cross-checked customers' pain points with the features designed in the competitors’ systems and started collecting ideas for the features we can implement.

It was clear that the solution to the unbanked SMEs sector in Egypt is not about reinventing the wheel, instead it was all about bridging the gap between the banking sector and unbanked SMEs.

Problems identified like the long process, lack of visibility over the process, lengthy access to liquidity and challenging acceptance criteria were among the strongest reasons why SMEs who trust banks to be the best financial institution, are reluctant in dealing with them.

Based on our research and user testing, we were able to build a market network where we onboard all three parties involved in the financing cycle, and group them all together under a specific pre-approved financial process (by banks & regulators) from where clients can select a funding bank/institution, and institutions can have the flexibility of fully or partially financing clients independently, or even partnering with other banks or financial institutions.

The result was a multi-portal market network with each portal specifically designed with features that solve the problems we grouped from interviewing each of the three parties. Aiming to bridge the gap between them and build a common ground for a seamless financial process that meets each party’s needs.

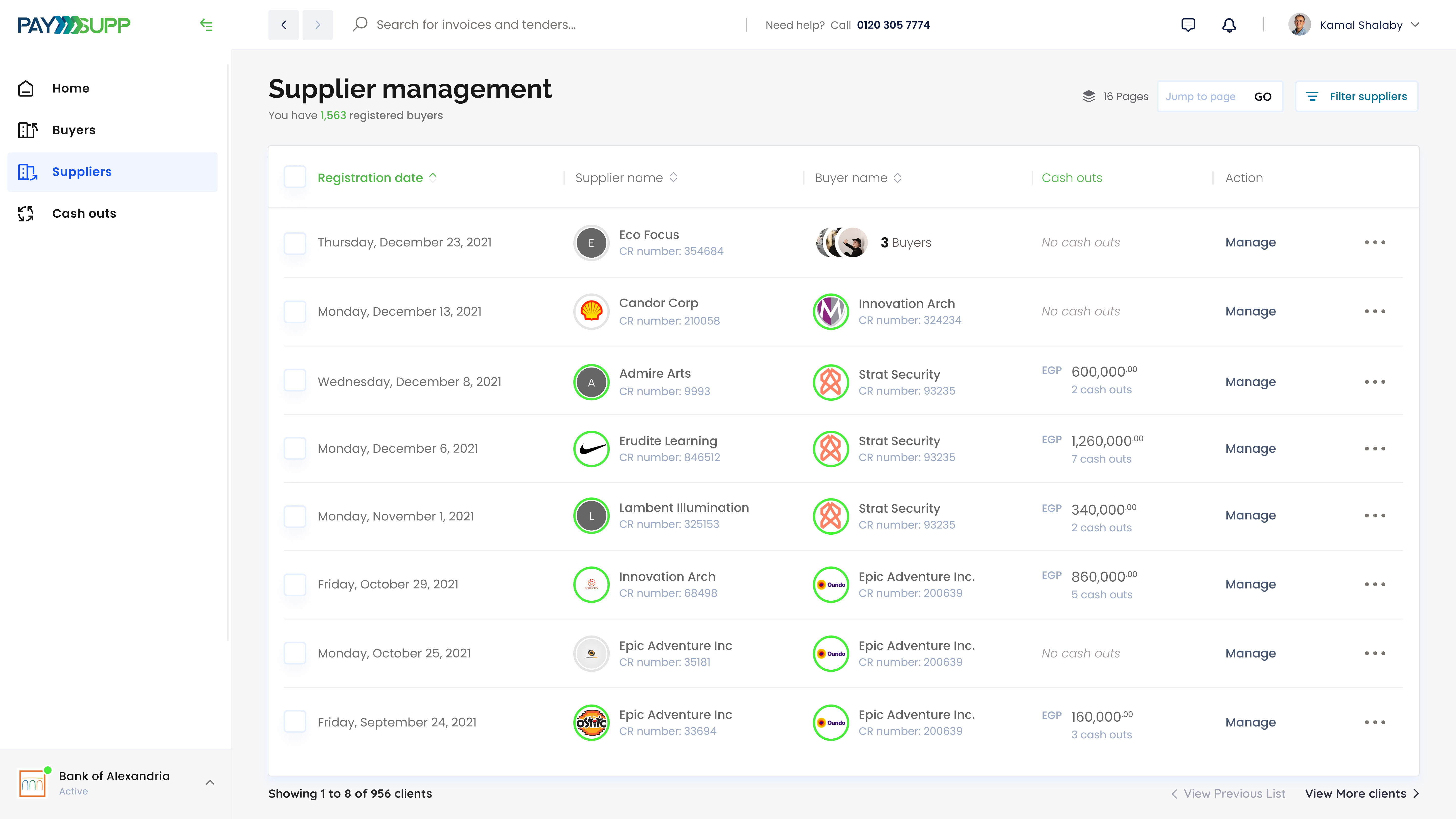

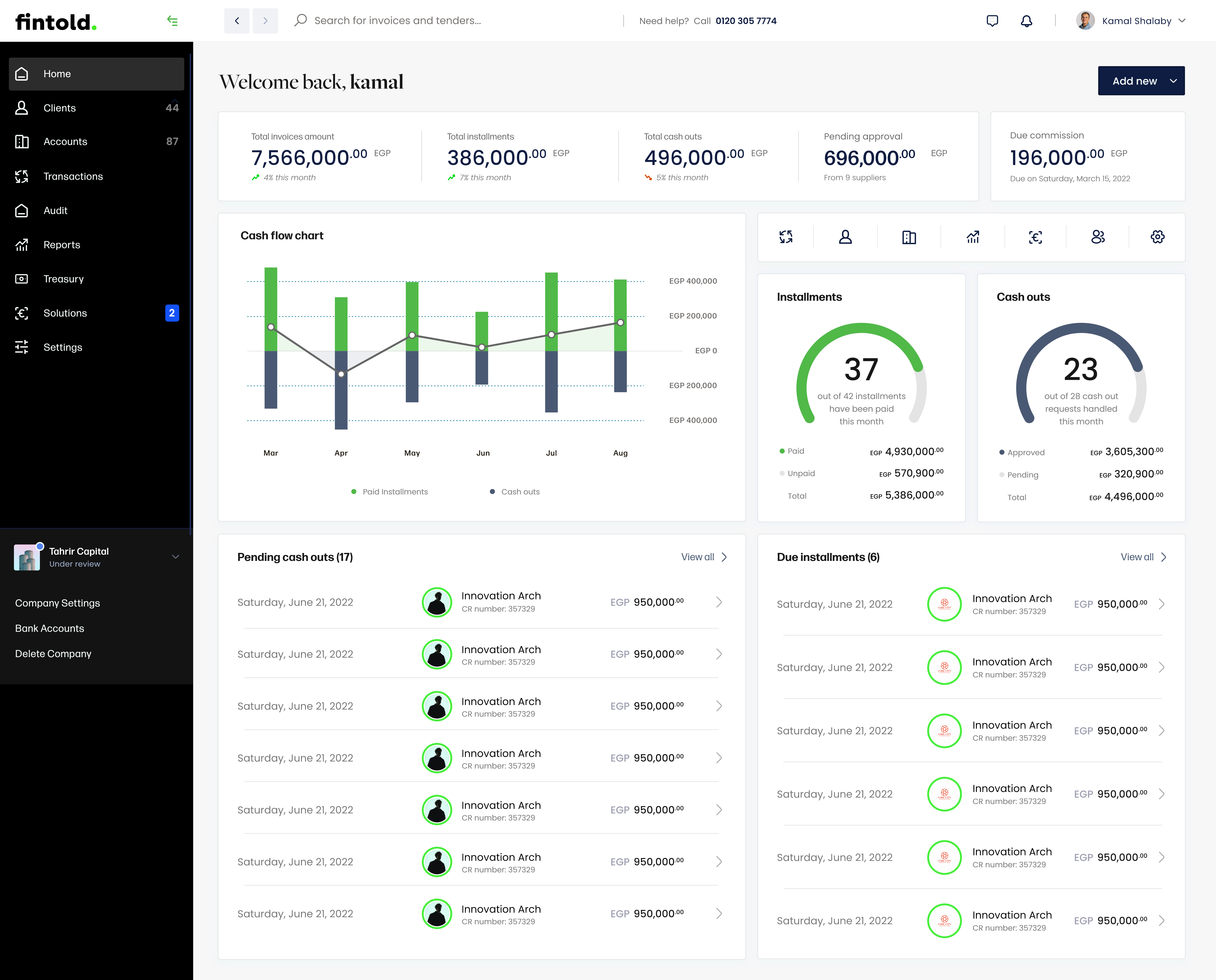

Giving banks visibility and control over their financed clients, with a detailed overview of their transactions, approvals, and reviews of applications and cashout requests.

With different needs, come different features. Mainly we allowed NBFIs to control the gate entry of their clients that have been onboarded to the market, giving them the ability to review their documents & applications, collect fees, negotiate referral fees, and more...

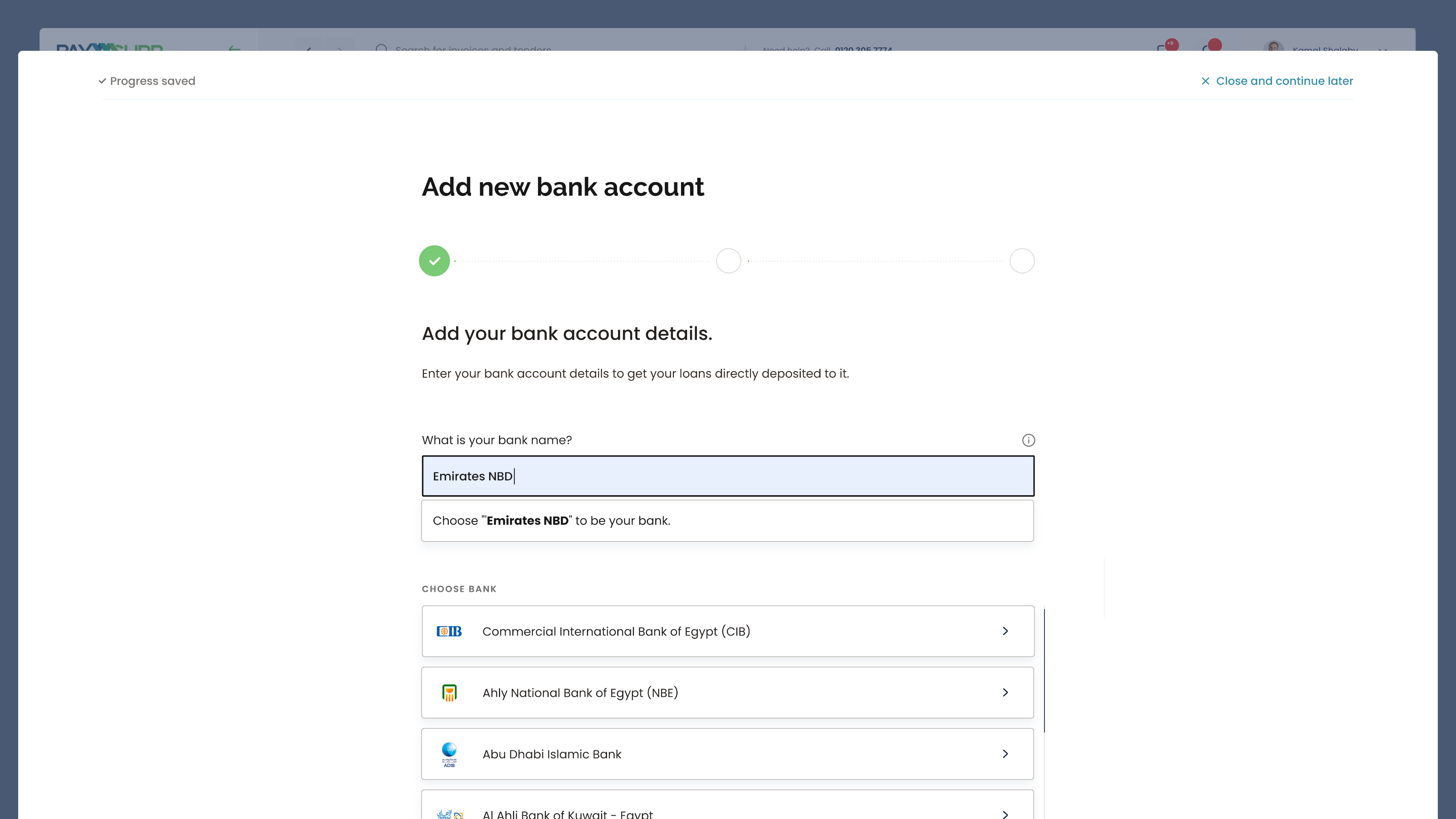

This portal allows clients to choose their financial products & their desired funding bank, upload required documents, fill in needed details, track their approval processes, upload their invoices, onboard their suppliers, track transactions, and more...

This portal is for admins in Fintold to have basic access to the system; manage registered entities, track system health & status, manage commissions, and more...

As a result of my work in the design department and with the help of the awesome team and managers in the company, I was able to help the company to:

We were able to design the product in a way that meets the CBE’s regulations and requirements, all while meeting the users’ needs and solving their problems.

After banks reviewed our proposed financial process and portal, banks were satisfied with the system we created, and we were able to onboard the biggest banks in Egypt to our system.

Businesses were satisfied with the services, ease of use, and features available to them for the first time in the Egyptian market. We were able to onboard businesses on our system and have them conduct successful transactions.

Overall, the biggest impact was our success in stepping into the market, despite all the challenges that have been faced and yet to come, we were able to accomplish a product market fit for our launching and there is no limit as to where we can go from there!

We proved the usability of the platform by onboarding businesses to the system who were able to perform transactions across all designer portals in millions of pounds.

Coming from a failed startup that I launched before I joined Fintold. I was so motivated this time to try working with a holistic understanding and vision of the product instead of my focus on perfecting features. I was able to learn how to pinpoint the main user needs/pain points and to find and test solutions that can both solve users’ problems and achieve our business goals, taking our resources and timeframes into consideration.

I learned how to work in a collaborative environment since this was the first time I lead and work with other designers on the same team. I was able to delegate tasks, set road maps, prepare educational material, give & receive feedback and report performance to my superiors.